WV CD-3 2005-2025 free printable template

Show details

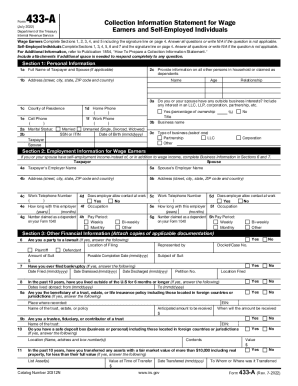

West Virginia State Tax Department Offer In Compromise Form CD-3 Revised 4/05 Taxpayer Representative Name Names and Address of Taxpayer Address Phone Social Security or Tax Identification Number To State Tax Commissioner Amount of Offer Total Liability This offer is submitted by the taxpayer to compromise a state tax liability for the following taxes and periods TYPE TAX Date PERIODS TAX INTEREST ADDITIONS TOTAL The total amount of is offered to compromise this liability. The total amount...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wv cd comptroller form

Edit your west virginia offer in compromise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wv compromise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wv state form 433 a online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit wv offer in compromise form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wv cd 3 form

How to fill out WV CD-3

01

Gather all necessary information such as your identification details, vehicle information, and any relevant documents.

02

Obtain the WV CD-3 form from the West Virginia DMV website or local office.

03

Fill out your personal details in the designated fields, including your name, address, and contact information.

04

Provide the vehicle information, including the make, model, year, and VIN (Vehicle Identification Number).

05

Indicate the type of transaction you are submitting (e.g., title application, registration, etc.).

06

Review all the information for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed form to the appropriate DMV office along with any necessary payment or documents.

Who needs WV CD-3?

01

Individuals registering a new vehicle in West Virginia.

02

Anyone applying for a title transfer or duplicate title.

03

Vehicle owners needing to update their records for any reason with the DMV.

Video instructions and help with filling out and completing wv form cd

Instructions and Help about form cd 3

Fill

wv state tax offer in compromise form

: Try Risk Free

People Also Ask about west virginia offer

Do I need to file a WV tax return?

ing to West Virginia Instructions for Form IT 140, "you must file a West Virginia tax return if: You are a full year resident or part year resident of West Virginia. You were a nonresident and your federal adjusted gross income included taxable income from West Virginia sources.

Does West Virginia require estimated tax payments?

You must make quarterly estimated tax payments if your estimated tax liability (your estimated tax reduced by any state tax withheld from your income) is at least $600, unless that liability is less than ten percent of your estimated tax.

How do I close my sales tax account in West Virginia?

Visit the State Tax Department Business Registration section online for more information, or contact (304) 558-3333, or toll free (800) 982-8297 for further assistance terminating your business registration through the Tax Department.

How long does it take to establish residency in WV?

You are considered a resident of West Virginia if you spend more than 30 days in West Virginia with the intent of West Virginia becoming your permanent residence, or if you are a domiciliary resident of Pennsylvania or Virginia and you maintain a physical presence in West Virginia for more than 183 days of the taxable

How do I pay estimated taxes in WV?

You can use the Pay Personal Income Tax link on the MyTaxes Website. website to begin remitting payments electronically using the ACH Debit method. Credit Cards – All major credit cards accepted. You can visit the Credit Card Payments page for more information.

What is the easiest way to pay estimated taxes?

Using the Electronic Federal Tax Payment System (EFTPS) is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits (FTDs), installment agreement and estimated tax payments using EFTPS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send west offer state to be eSigned by others?

Once your 3 cd form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit wv tax payment plan in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing wv cd3 fillable and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit west tax 3 form on an Android device?

You can edit, sign, and distribute wv offer on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is WV CD-3?

WV CD-3 is a form used in West Virginia for reporting corporate distributions, specifically relating to the distribution of dividends, interest, and other income.

Who is required to file WV CD-3?

Corporations and other entities that distribute taxable income to their shareholders or members in West Virginia are required to file WV CD-3.

How to fill out WV CD-3?

To fill out WV CD-3, provide the required information such as the entity's name, tax identification number, details of the distributions made, and the recipients' tax information. Follow the instructions provided on the form carefully.

What is the purpose of WV CD-3?

The purpose of WV CD-3 is to report distributions made by corporations and other entities to their shareholders or members, ensuring compliance with West Virginia tax laws.

What information must be reported on WV CD-3?

Information that must be reported on WV CD-3 includes the name and address of the entity, the total amount of distributions, the type of income, and the names and Social Security or tax identification numbers of the recipients.

Fill out your WV CD-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offer Acceptance is not the form you're looking for?Search for another form here.

Keywords relevant to form tax cd3 form

Related to wv cd 3 fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.